Apprenticeships may have centuries of history, but in the last decade or so they have been transformed to serve the most dynamic, wealth-creating and durable careers in modern society. Nowhere is this shift more apparent, and more urgent, than in financial services.

From private equity and wealth management to banking and venture capital, the financial services sector is a cornerstone of the UK economy, employing 1.1 million people across the country and contributing 8.6% to all economic output.

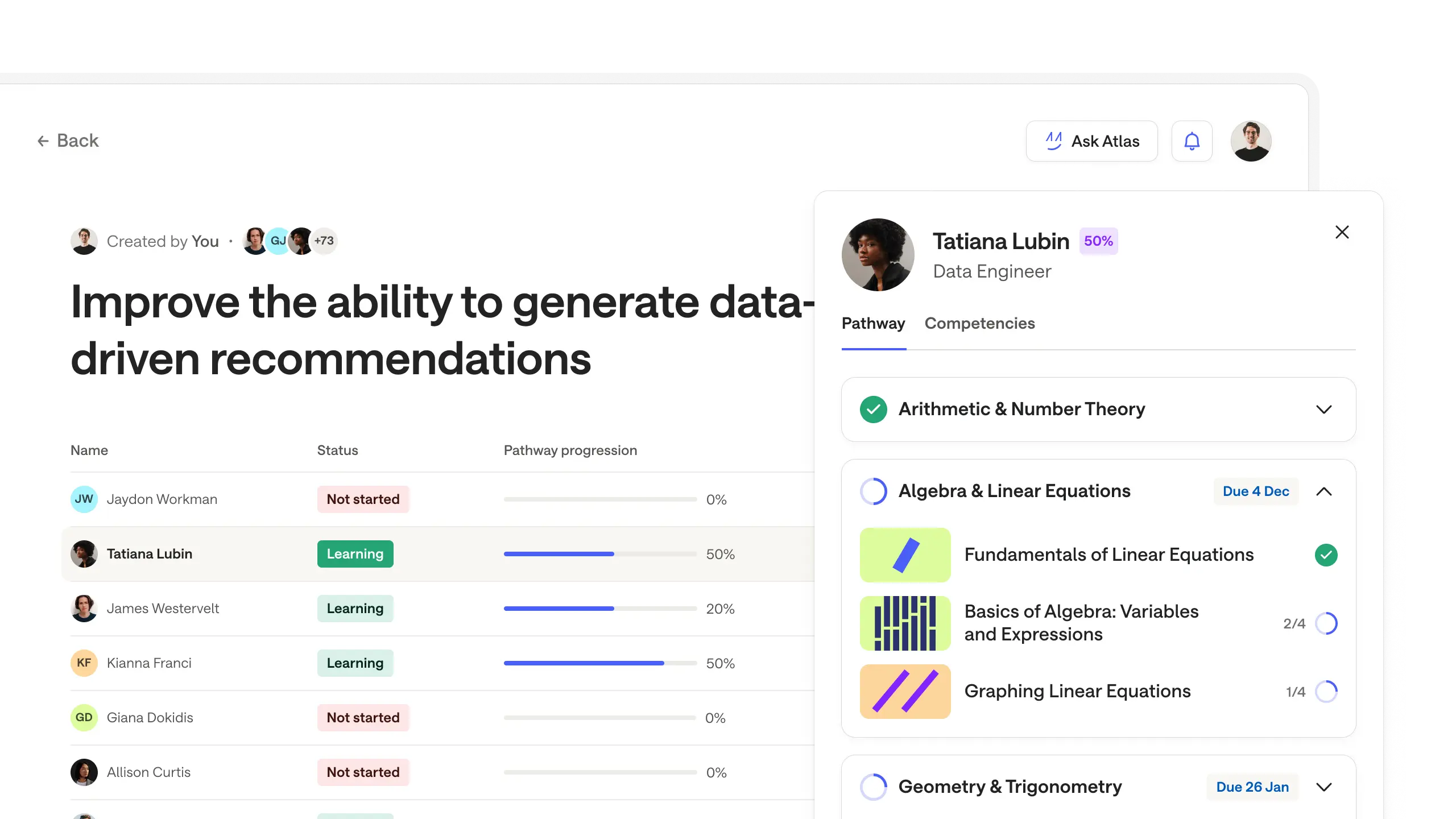

But as an industry, it’s going through deep and profound changes. Digital transformation is reshaping how financial institutions do business. Artificial intelligence, machine learning, high-end data analytics, and software and product design are all becoming core parts of how firms work. And as these skills become increasingly important for more businesses, skills gaps widen and recruiting talent becomes even harder.

So what does our research find?

- The skills that financial services companies need are constantly shifting. More than a quarter of the top skills required to do a financial services job are different in 2022 compared to 2015 and this is expected to shift even further.

- Digital transformation is the biggest driver of these changes. 83% of financial services employees think jobs in the industry will be significantly impacted by digitalisation. Almost two thirds (64%) believe colleagues without digital data skills are most at risk of redundancy.

- Financial services companies are struggling to find candidates with the necessary skills to fill these new roles. Vacancies in the financial services sector hit 55,000 in the second quarter of 2022, up more than 70% on the same period the previous year.

- Nearly two in five people working in financial services (39%) did not think they would be working in the sector in the next five years. But of that group, two thirds said they would likely stay longer if they were offered retraining.

- One of the biggest recruitment priorities in financial services is diversity and inclusion, but employers are struggling to meet their ambitions. Generally, employees say they are successful at attracting candidates from low-income backgrounds, but see attracting candidates from ethnically diverse backgrounds as a big challenge.

- Skills gaps are a cause for concern in the industry. 87% said they had an impact on productivity, and 88% believe they are affecting employee retention. Senior leaders at financial service businesses were even more concerned, with 93% reporting that skills gaps had an impact on productivity and 94% saying that they affected employee retention.

- Apprenticeships are an effective way to help plug skills gaps, both at entry level and above. Two-thirds of financial services employees (66%) thought that skills gaps could be tackled by hiring more apprentices. Employees also widely believe that they can help solve diversity challenges. Support was greatest among those who directly manage or work with an apprentice, of whom more than 85% would recommend hiring an apprentice to a colleague.

This report explores these challenges using new research, and lays out how apprenticeships can be part of the solution, helping to build financial services firms that are fit for the future.

Apprenticeships don’t just provide an outstanding alternative to university for entry-level talent. As professionals across the financial services industry argue, they provide high-quality reskilling opportunities for existing staff as well.

The world of work is changing quickly. Let’s make sure our financial services sector can keep up.